Helping Accountants Advance SME Growth

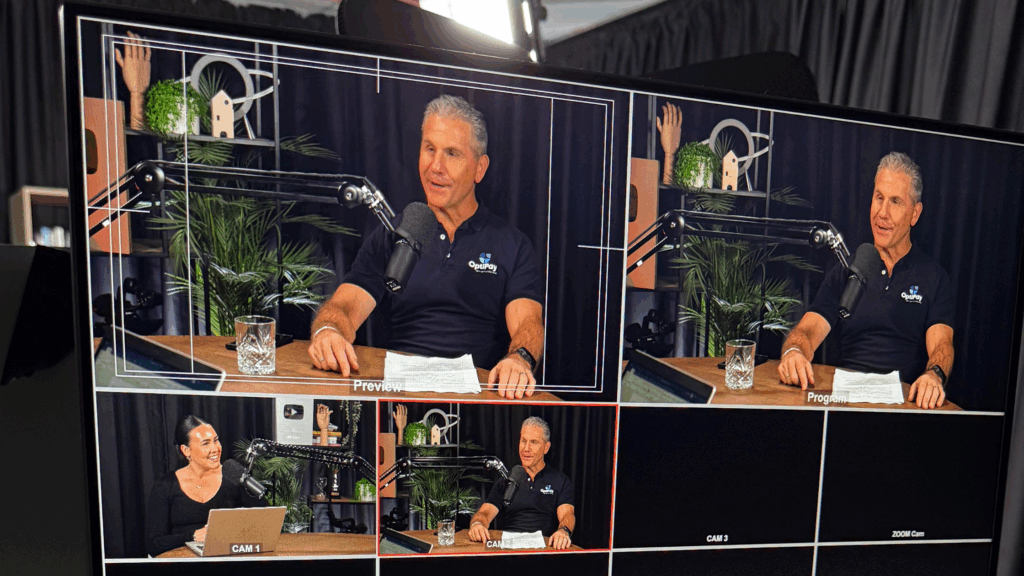

A Conversation with Accountants Daily The role of accountants is evolving. Beyond compliance, businesses are looking to you for guidance on market share growth, resilience, and cash flow strategy. That’s why we were excited to feature on the Accountants Daily Insider podcast, where our CEO, Angus Sedgwick, sat down with host Imogen Wilson to discuss: […]

Mitigating Late Payments: Automated Reminders & Invoice Finance as Safety Net

Late payments are more than just a nuisance for Australian businesses. They are one of the most common and persistent cash flow challenges. Whether you’re a startup or a growing enterprise, chasing unpaid invoices can drain resources and make it harder to plan. Whilst payment delays may not always be ill-intended or intentional, businesses need […]

How Seasonal Retailers Can Stay Flexible with Invoice Factoring

Running a seasonal retail business is a balancing act. When demand surges during the summer or winter months, inventory needs to be high, staff must be ready, and marketing needs to be sharp. Then the quieter months roll in, and the focus shifts to managing overheads, preserving cash, and preparing for the next seasonal wave. […]

Invoice Finance vs. Business Loans: A Side-by-Side Comparison for SMEs

For small and medium-sized businesses, access to funding can mean the difference between drowning and growing. Whether you’re hiring staff, investing in marketing, or simply keeping up with rising operating costs, having the right kind of financial strategy is essential. The challenge is not just sourcing funding, but choosing the funding avenue that best suits […]

Navigating ATO Changes in 2026: What You Need to Know About Tax & Payment Plans

As we enter FY26, many Australian businesses are looking ahead to changes in tax compliance and payment obligations introduced by the Australian Taxation Office (ATO). While most business owners are familiar with the routine pressures of EOFY reporting, this year presents a more complex landscape. From stricter enforcement around overdue tax debts to greater scrutiny […]

Unlocking Growth for Trades Businesses: Invoice Finance for Electricians & Plumbers

Electricians, plumbers, and other tradesmen help to keep both homes and businesses functioning safely. These small trade businesses are the backbone of Australia’s infrastructure, yet despite being essential, many of these businesses struggle to manage their cash flow due to the project-based nature of their work. One month might be packed with projects while the […]

Sector Spotlight: How Invoice Finance Helps Hospitality Businesses Bounce Back

Businesses who operate in the hospitality sector, whether it be your local café or a luxury hotel, play a key role in Australia’s economy. However, this space also comes with some of the toughest financial challenges; high overheads, seasonal fluctuations, and unpredictable income are everyday realities for many hospitality businesses. Whilst these post-pandemic years have […]

Bridging the Payroll Gap: Invoice Finance Solutions for Labour Hire Companies

Australians turn to labour hire for a range of reasons. From meeting short-term or fluctuating workforce demands to tapping into specialised skills without the constraints of long-term employment. For businesses, it offers the agility to scale quickly and manage costs during peak periods. For workers, it provides flexible job opportunities and valuable experience across a […]

Invoice Finance vs Traditional Business Loans: Pros and Cons for Australian SMEs

When cash flow gets tight, many Australian business owners find themselves weighing up two main options: applying for a traditional bank loan or using alternate financing methods, like invoice finance. They can both support your cash flow needs, but they work in fundamentally different ways. It’s important to assess all available options to make the […]

Strengthening Wholesale Trade with Invoice Factoring: Keeping Cash Flow on Track

When it comes to wholesale trading, timing is everything. Wholesalers and distributors sit at the core of Australia’s supply chain, purchasing in bulk from manufacturers and delivering products to retailers around the country. Yet, while this model offers scale and efficiency, it also comes with a key challenge: cash flow strain. Most wholesalers pay their […]