Regardless of how much experience you have in the mining industry or how stable your business happens to be, late payments can spell trouble for just about anyone. Businesses may pay their suppliers late for an unfortunately large number of reasons, from lengthy internal approval processes to receiving the invoice later than they expected to simply running out of the funds to do so.

Did you know that all across Australia, small and medium-sized businesses are currently dealing with $76 billion worth of outstanding invoices? If you break that number down further, that means that each business is owed roughly $38,000 at any given moment. If anything, take comfort in the fact that this isn’t a problem you’re dealing with alone.

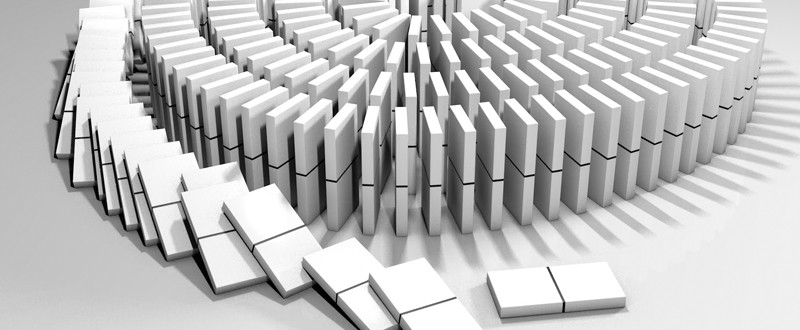

In the mining industry in particular, one late payment is rarely an isolated incident. Payments tend to get later and later as they move further down the chain of suppliers, which is where the dreaded “Domino Effect” rears its ugly head.

The domino effect: what you need to know

Consider a supplier chain involving five different companies. If Business #1 pays Business #2 a week late, then that guarantees a late payment for Business #3 and so on down the line. Meanwhile Business #2 may have their own late payment issues to contend with, ensuring that Business #3 doesn’t actually see its cash for another week on top of that. Things get later and later that it has reached the point where Business #5 actually receives their money months after it was due. While everyone waits around to get paid, the last business is always the one struggling the hardest — and this is could be a reason they’d go out of business.

The important thing to understand is that if a customer goes bankrupt, or if supplier payment periods are extended (as Rio Tinto tried to do by extending their own payment periods to 90 days), this has an immediate impact on everyone else.

Because of the domino effect, companies often scramble to find mission-critical funds and often have to turn to expensive solutions like loans to hold them over. They don’t fix the problem, however — only temporarily put it off. Money lost through interest and other last-minute fixes can still make it even harder to pay the next supplier in the chain, thus doing nothing to ward off the domino effect itself.

Stopping the domino effect in its tracks

One of the factors that makes the domino effect in the mining industry so strong is its unpredictability. Despite your best efforts as a seasoned industry veteran, it can and will strike when it’s least expected. One of the best ways to navigate around this uncertainty is to embrace solutions like invoice financing.

In an invoice financing situation, a financier buys your outstanding invoice and advances you 80% of the money associated with it for a nominal fee. The remaining value is paid to you after the customer pays for the invoice in question. It’s a “best of both worlds” situation as you get the cash you need now and you avoid the hassle of more expensive options like interest-laden loans.

You can use that money today to pay for your staff and other payroll considerations, take advantage of limited time investments, secure your assets, and more. Additionally, it makes it easier to plan for the future and grow your business as even though invoices are late, you still have a steady stream of cash flowing in at all times.

Invoice financing and the mining industry: a perfect match

Because of the way purchasing chains operate in the mining industry, the domino effect is unfortunately not something you’ll ever be able to eliminate entirely. With options like invoice financing, however, you can mitigate the damage as much as possible and keep your business running smoothly at the same time. You get to maintain positive relationships with clients and you get the added benefit of getting 80% of the cash associated with late invoices immediately. In many ways, invoice financing is the perfect solution that mining industry professionals across the country have been waiting for.

If you’d like to find out more about invoice financing, have a look at how to pick the right B2B funder for your business.

Who is OptiPay?

OptiPay, one of Australia’s leading business finance providers, has been dedicated to helping small business owners solve cash flow challenges for over a decade and has provided $1.5 billion in business funding to more than 500 Australian businesses. OptiPay specialises in modern financing solutions such as invoice factoring, invoice finance, debtor finance, and lines of credit. OptiPay’s mission is to support business growth providing liquidity in as little as 24 hours, ensuring they have access to tomorrow’s cash flow today. This rapid access to funds helps businesses maintain smooth operations and seize growth opportunities without the stress of cash flow constraints. At OptiPay, we believe that healthy cash flow is the lifeblood of any successful business. Our commitment to helping businesses overcome financial hurdles and achieve their growth ambitions has solidified our reputation as a trusted partner in the business finance sector. Whether you are looking to stabilise your cash flow, expand your operations, or navigate financial challenges, OptiPay is here to support your journey with innovative and efficient financing solutions.