Industry Spotlight: How Cash Flow Funding Solutions Differ for Service vs Manufacturing Businesses

Cash flow challenges show up differently depending on the type of business you run. A service business might feel the pressure when payroll hits before clients pay their invoices. A manufacturer might feel it when raw materials need to be purchased months before finished goods are delivered. Both rely on steady working capital, but the […]

Navigating Seasonal Peaks and Troughs: How Debtor Finance Helps Businesses Ride the Cash-Flow Cycle

Seasonal and cyclical businesses have to learn to strategically manage ebbs and flows. Some months are full of activity, with orders coming in faster than the team can process them. Other months are much, much quieter. Labour hire firms feel this when major projects begin and end. Manufacturers see it when production ramps up before […]

Seven Strategic Questions to Ask When Choosing an Invoice Finance Provider

Choosing an invoice finance partner is not something most business owners take lightly. Cash flow is the lifeline of every company and when you bring in a provider to help unlock the value tied up in your receivables, you want to ensure they understand the reality of running a business in fast moving markets. The […]

Debtor Finance Demystified: How Australian B2B Businesses Can Turn Invoices Into Growth Capital

If you’ve ever found yourself staring at a stack of unpaid invoices while juggling payroll, supplier bills, and a growing to-do list, you’re not alone. For many Australian businesses, the gap between delivering work and getting paid is one of the most frustrating parts of running a company. Debtor finance is a way to unlock […]

How Australian SMEs Can Use Invoice Discounting Without Losing Control of Their Customer Relationships

For many Australian business owners, the biggest frustration isn’t finding customers, it’s waiting to get paid by them. You’ve delivered the service, sent the invoice, and have done everything right, but the funds don’t arrive for another 30, 60, or even 90 days. Meanwhile, wages, rent, and supplier bills don’t wait. That constant mismatch between […]

Beginner’s Guide to Debtor Finance: What It Is, How It Works & Whether It’s Right for Your Business

For any business owner, the anxiety of delivering a service or product but having to wait for cash as bills become due shows the constant struggle of working capital. Your staff and suppliers need to be paid today, but your big customer won’t pay their invoice for another 30, 60, or even 90 days. This […]

7 Questions Australian Businesses should ask themselves when choosing an invoice finance provider

Invoice finance has been growing in popularity as a tool for Australian businesses to use to manage cash flow without taking on traditional debt. However, choosing the right provider can be a challenge. WIth more platforms entering the market and the influence of technology changing the way finance is delivered. The decision on which […]

Innovations in Invoice Finance: AI-Based Risk Assessment & Faster Cash Access

In recent years, the fintech landscape has been shifting quickly. From digital wallets to embedded finance, the goal has been consistent across the board: make finance faster, smarter, and more accessible. Invoice finance is no exception. Once seen as a traditional solution used mainly by businesses in a cash flow crunch, it’s now undergoing a […]

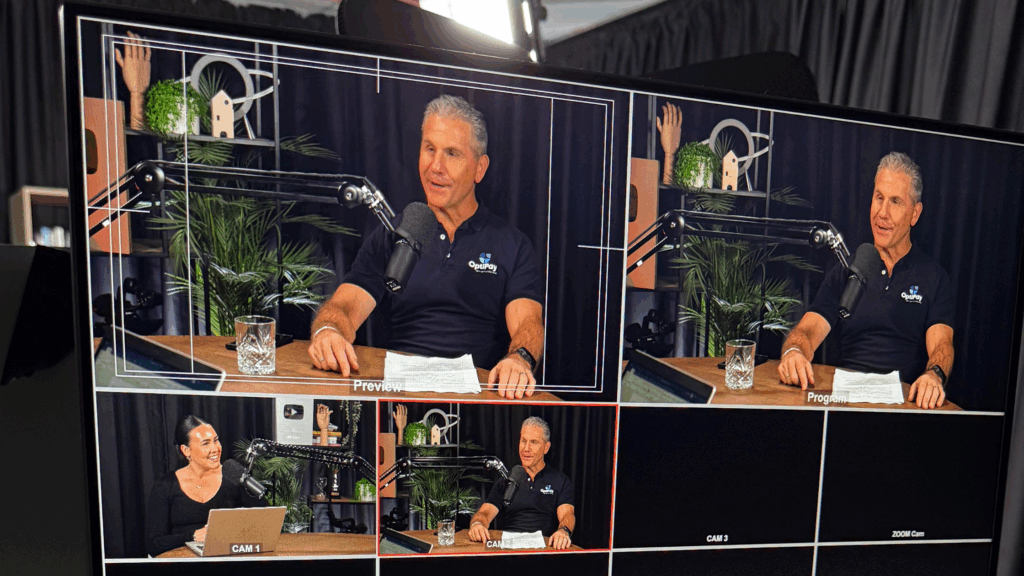

Helping Accountants Advance SME Growth

A Conversation with Accountants Daily The role of accountants is evolving. Beyond compliance, businesses are looking to you for guidance on market share growth, resilience, and cash flow strategy. That’s why we were excited to feature on the Accountants Daily Insider podcast, where our CEO, Angus Sedgwick, sat down with host Imogen Wilson to discuss: […]

Mitigating Late Payments: Automated Reminders & Invoice Finance as Safety Net

Late payments are more than just a nuisance for Australian businesses. They are one of the most common and persistent cash flow challenges. Whether you’re a startup or a growing enterprise, chasing unpaid invoices can drain resources and make it harder to plan. Whilst payment delays may not always be ill-intended or intentional, businesses need […]