Off Balance Sheet is not a Dirty Word

Talk to a salt of the earth Australian businessman about off-balance sheet financing, and he’s likely to look at you askance. Quite rightly, people want to do things by the book, especially when it comes to business financing. But that doesn’t necessarily mean on the books. That’s because the practice of raising funds in a […]

The Most Underutilised Asset in Business

Most small businesses have ambitions to grow – whether to become a global mega-corporation or just to establish a more secure and comfortable future for their owners. In order to do this, their people and assets need to work harder, and they will also probably require funding. What if we told you that there’s an […]

Regional accounting practice adds significant $$$$ value.…

OptiPay received an enquiry from a mid-size regional accounting practice. Their brief was as follows: Their client was a successful (small) engineering and fabrication business and was submitting a tender for a significant regional infrastructure project. Their client was up against a number of significant players including an ASX listed building and engineering group. The […]

Terms & Conditions help with financing – and business in general

Flexible invoice discounting means you can get access to the money you are owed immediately, but it doesn’t mean that you should let customers walk all over you. Every Australian business has a right to be paid within a reasonable timeframe, and should make that clear in a key document that every business should have: […]

Calculating The Real Cost Of Business Lending – Part 2

In the previous blog of this series, we looked at how to calculate the cost of business funding, and found some surprising results: Business loans which you have to pay off over a period of years can turn out to be more expensive that they look. Because most lenders charge fees for setting up and […]

Calculating The Real Cost Of Business Lending – Part 1

Finding out the real cost of financing your business is a crucial part of any plan to expand, boost profits or just improve your cash flow. Unfortunately, this basic task is not always easy. Getting a real cost before agreeing a business loan means digging into the small print and getting your calculator out. However, […]

Serious savings and opportunities

Our software/consulting client had been in business just under eighteen months. They provided software solutions to a Government Department on 60 day terms and developed a security protocol for a shipping and logistics company on 45 day terms. The combined amounts due to our client was $480,000.00. The client had retained a range of contractors […]

Innovation at work for business

So, you think all cash flow solutions are the same worn out beast……… Well, read this! A specialist Engineering Company involved in a JV for the delivery of Precast Concrete Tied Wall panels required a smart solution to secure the contract. In order to manufacture the product the client had to purchase the raw material […]

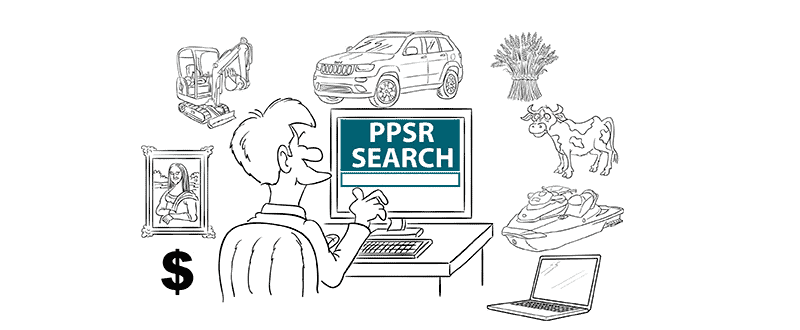

Why every small Australian business should use the PPS Register

When it comes to asserting ownership over their assets, Australian businesses should be well placed compared to international peers. Unfortunately, many small firms are still losing money and missing out on low-cost business financing opportunities because they are failing to use a key facility their government has provided. The introduction of the Personal Property Securities […]

Cashflow: The Biggest Killer Of Small Businesses

Invoice Financing, Not Business Loans, Can Beat The Late Payers Threatening Australian Business Running a business means taking charge of your future, and the rewards in terms of money, lifestyle and satisfaction are great. But no-one could claim that it’s the safe option: about two thirds of start-ups fail in their first three years, according […]