How to Ensure Your Business Succeeds in FY20

The start of a new financial year is a great time for business owners to consider how they can ensure the next 12 months will bring sustainable business growth and financial security. With your latest accounts in front of you, there’s no better time to ask a few key questions about your business’s financial performance […]

What Do Low Interest Rates Mean for SMBs?

After two back-to-back interest rate cuts, Australian businesses could be forgiven for thinking that there has never been a better time to borrow money. However, Reserve Bank governor Philip Lowe has made clear these historically low interest rates come as a response to rising unemployment and a slowing economy. So what do the latest low […]

Why Business Failures are Increasing

As we announced our re-branding to OptiPay this week, we talked about the need to provide suitable growth funding for Australian businesses. The fact is that while the economy has been growing for a decade, the business failure rate jumped a notch last year. The 12.7% increase in failed businesses in the Australian market is not just […]

Import Finance for Healthcare Companies

Imports are crucial to the Australian healthcare sector. From the latest medical devices to standard pharmaceutical supplies, most healthcare providers rely on things that are manufactured abroad – but many still buy them from suppliers in Australia. This, of course, comes at a price.In a growing but highly competitive industry, significant cost advantages can be […]

Cost Effective Finance for your Business

Over the last few weeks we’ve looked at the kinds of business that can use Invoice Finance, how it can be a key source of funding, and just how much cash can be raised. We’ve seen that more and more businesses are choosing Invoice Finance. In some countries, such as Britain, it is now rivalling […]

What is Invoice Finance and who is it for?

We’ve discussed many aspects of Invoice Financing prior to this blog but perhaps it’s time to go back to basics – after all, more than 30% of eligible businesses are sadly still unaware that it exists. Also known as Invoice Discounting or Debtor Finance, Invoice Finance is a form of business funding which sees cash […]

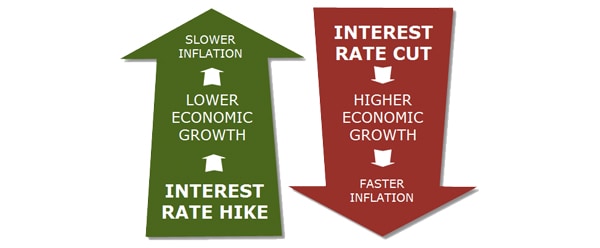

A Matter of Interest: How the Reserve Bank of Australia Affects Your Business

The Reserve Bank of Australia kept interest rates on hold this month, but many commentators believe it will cut them at least once before the end of the year. What does this mean for businesses and their ability to finance their plans? As a small or medium sized-business owner, you are probably focused on your […]

Turn Cash Flow into an Asset

Cash flow is a word that can strike fear into business owners, because it’s often followed by the word ‘problems’. However, it doesn’t have to be that way: if managed correctly, a business’ cash flow situation becomes an asset that can be used to fund investment and growth. The way you think about cash flow […]

Financing the Final Frontier

Since the Australian Space Agency was belatedly founded last year, interest in the country’s space sector has been rocketing. The fledgling agency recently announced a “statement of strategic intent” with aerospace giant Boeing as part of plans to grow Australia’s space market from about $2.8 billion to $8.6 billion by 2030; and just last week, […]

SME Tax Cuts Can Fund Growth

When a government announces tax cuts for business, there is always a simple premise behind the move: it is aimed at encouraging growth. The recent Australian Federal Budget is no different, and businesses will seize the opportunity to invest in themselves. Targeting businesses with an annual turnover of less than $50m, the government recently promised […]