5 Tips for Picking the Right B2B Funder for Your Business

For small- to medium-sized businesses in particular, bringing on a B2B funder is often one of the best ways to help navigate the admittedly rough and unpredictable waters of the entrepreneurial life. Customers who can never seem to pay on time have devastating consequences to even the strongest businesses, to say nothing of the seasonal […]

3 Marketing Hacks You Need To Know

Make your business stand out against the competition in 2017 with these four smart marketing hacks. The rise in digital technology means most people can usually be found carrying a mobile device or laptop. The landscape of marketing online is very different from the traditional approach of brochures and television ads. These four trends will […]

Extended Supplier Payments – How to Beat the Bullies

2016 has been a year filled with extended supplier payments. From Rio Tinto’s extension from 30 days to 90 days to Kelloggs and Fonterra stretching payments to 120 days — how can you ensure steady cash flow in your business and beat the bullies? Understanding your loss Lack of cash flow is causing a loss […]

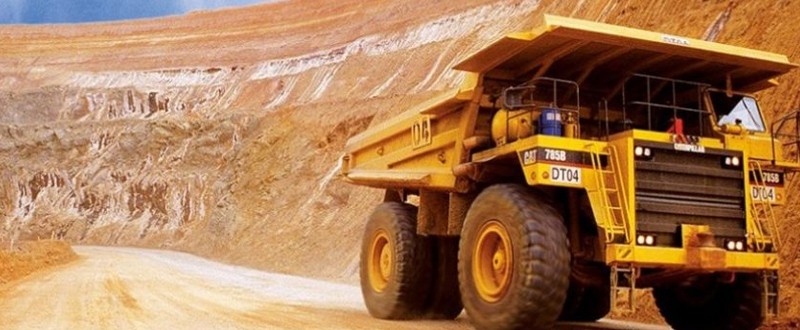

5 Ways to Boost Cash Flow for Mining SMEs in the New Year

The mining industry is highly competitive and often characterised by enormous projects with huge budgets. When payments are stalled, business owners need to make a serious plan when it comes to managing cash flow in the New Year. Take responsibility for what you can control It’s easy to blame your customers for lengthy payment periods, […]

Why Cash is Still King in Business

Running a business is similar to running a household. There are key stakeholders, mouths to feed, and relationships with other ‘families’ — all as a means to maintain life. Cash in a business is crucial. It’s the on and off switch that fuels business growth and keeps operations running smoothly. Here are four reasons why […]

Why You Need to Know About Invoice Financing Now

Invoice financing is a great way to ensure consistent cash flow in your business. When dealing with slow debtors — having a third party purchase your invoice alleviates a lot of the business pains caused by slower payments. Consistent cash flow also means you can spend more time allocating capital to internal resources, infrastructure and […]

3 Trends For The Australian Business Landscape In The New Year

As a business owner, having your finger on the latest trends has a direct impact on the success of your business. Understanding these three trends will help you hammer out an effective business strategy in the New Year. Big companies extend supplier payments up to 90 days Extended supplier payments means smaller businesses are forced […]

Webinar: How to get the best cash flow for your business

http://www.youtube.com/watch?v=wDZHnnEBsC4 Who is OptiPay? OptiPay, one of Australia’s leading business finance providers, has been dedicated to helping small business owners solve cash flow challenges for over a decade and has provided $1.5 billion in business funding to more than 500 Australian businesses. OptiPay specialises in modern financing solutions such as invoice factoring, invoice finance, debtor finance, and lines […]

Avoid The Christmas Cash Flow Crunch

Although many Australian businesses experience their highest sales during the Christmas period, for some it can be the toughest time to maintain healthy cash flow. Businesses in a number of sectors suffer a decrease in production and sales and may shut down completely for a couple of weeks. At the same time, they still have […]

Cash Flow Help For Australian Transport Companies

Most Australian trucking companies are started by drivers who invest their own money to buy a truck and launch and operate the company. While many drivers have a great deal of industry experience, they don’t necessarily have a lot of capital to support the business in the early days. Often, this stops them from reaching […]