SME Cash Flow Tips for 2017

Most companies stall or fail not because of bad product but because of bad cash flow. If you are among the SMEs that leave invoices outstanding, then you are a part of a $76 billion shortfall that sees half of companies completely fail before they reach year 4 of operations. 40% of SMEs leave an […]

The Dangers of Inconsistent Cash Flow in Business

Is your business dealing with extended supplier payments or seasonal fluctuations? Perhaps your customers just can’t seem to pay on time. Whatever the cause of your cash-flow strife, you’re not alone. According to our latest press release, Australia’s two million small- and medium-sized enterprises (SMEs) are drowning in a sea unpaid customer bills, with businesses […]

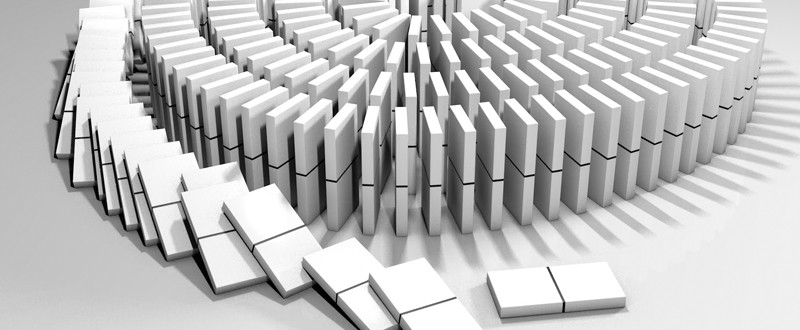

How to Navigate the Domino Effect in the Mining Industry

Regardless of how much experience you have in the mining industry or how stable your business happens to be, late payments can spell trouble for just about anyone. Businesses may pay their suppliers late for an unfortunately large number of reasons, from lengthy internal approval processes to receiving the invoice later than they expected to […]

Invoice Financing vs. Invoice Factoring: What You Need To Know

Invoice Financing vs. Invoice Factoring:What You Need To Know A consistent cash flow is the lifeblood of a business. It is how an organisation is able to purchase stock, hire and train staff, diversify and ultimately expand its practises. But what happens when this lifeline is interrupted? It is a question and a challenge that […]

How to Steady Your Cash Inflow

People have a way of forgetting that cash flow involves a whole lot more than just money coming into your business. In many ways, it’s a crystal ball that lets you see into the future. If you know where you want to be, cash flow is the pivotal road map that lets you know how […]

Is Your Website Converting Leads? 3 Tips to Kick Starting Lead Generation

Websites aren’t just a storefront — websites are a critical means of lead-generation for businesses. With around 3.2 billion people online, websites give businesses an unprecedented amount of access to potential customers. Within the last few years, there has been a steady hike towards businesses aiming to ‘revitalise’ their websites — all to ensure their […]

Put Debts in the Past with These 3 Strategies

Unpaid debts can drag your business down. The money that you are owed is not available to you for expansion or the day-to-day operation of your business. Chasing it down costs precious personnel hours that could be spent generating new income instead. And it can be demoralising for a small- or medium-business owner to do […]

OptiPay Featured on ABC, Channel 9, SBS and More —SME Cash Flow Crisis Report

Australian businesses are drowning under $76 billion worth of unpaid invoices. Our SME Cash Flow Crisis Report released on the 30th January, shines a light on the impact that these unpaid invoices have on Australian SMEs — and ultimately, our economy. Business owners don’t need to suffer silently or dig into personal savings to maintain […]

Press Release Monday 30 Jan 2017

Small business cash flow crisis costing Australian economy $76 billion AUSTRALIA’s two million small and medium sized enterprises (SMEs) are drowning in a sea of unpaid customer bills, with $76 billion worth of outstanding invoices crippling their ability to grow, new research has found. If the problem can be fixed, up to half a million […]

A Must-Read Inquiry into Slow Payments for Australian SMEs

Late payments are the biggest issue Australian SMEs face. With $26 million owed in unpaid invoices averaging around $13,200 each, these businesses spend over 12 days a year in business operations chasing unpaid invoices. A lack of cash flow means stalled business growth, which often leads to debt and, in the worst case, liquidation. At […]