The Reserve Bank of Australia kept interest rates on hold this month, but many commentators believe it will cut them at least once before the end of the year. What does this mean for businesses and their ability to finance their plans?

As a small or medium sized-business owner, you are probably focused on your core market and customers, rather than the national and global economy. You may well wonder if the RBA’s headline ‘cash bank rate’ affects you at all.

The short answer is that it can. Higher bank rates mean it is more expensive to borrow money and therefore harder to finance growth and investment in your business – eventually, even non-debt business funding such as Invoice Finance offered by OptiPay can be affected.

RBA Rate Affects Business Loans

Many business loans are directly tied to the RBA’s cash rate, and that means that your re-payments will go up or down immediately in response to changes to the official interest rate. Even fixed-rate business loans are affected because if banks even suspect a rate rise is coming they will push up the level of interest they are prepared to offer so as not to find themselves out of pocket when it happens. Businesses which already have a fixed-rate deal will, however, be protected from changes until their current agreement expires or they find they need to borrow more.

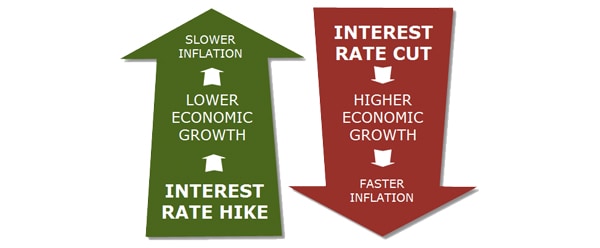

Eventually, higher base rates will make all forms of business funding more expensive. That is because everyone needs to get their money from somewhere, and all returns are theoretically relative to the rate safely available from the central bank.

As things stand in Australia, however, the RBA is widely understood to be contemplating a rate cut. This would mean those businesses on flexible rate loans would have a bit more cash to keep or invest every month (assuming the banks and other lenders reduce their rates in line with an interest rate cut), whilst those seeking new fixed rate loans may find the offers get more generous – although banks do not have the best track record for passing on the benefits of rate cuts to business.

How Would Lower Interest Rates Help?

Interest rate cuts are actually designed to boost the economy by ensuring that businesses and households have more money available to spend and invest – both because they are paying less interest on their debts and because they can access capital more cheaply and in theory, more easily.

Even if the big banks are unwilling to pass the rate cut on, smaller alternative lenders should find money easier to come by in a low interest rate scenario, and more innovative forms of finance should gradually reach the market in ever greater quantities. Businesses which benefit from more disposable income among their clients, for example, can use their growing Accounts Receivables book to raise immediate funds via Invoice Finance or vis the use of Supply Chain Funding, to ensure prompt payment to ones suppliers.

What Are The Downsides of a Rate Cut?

The biggest problem with a rate cut is that it traditionally signals a lack of confidence in the economy on behalf of the expert economists whose job it is to set rates. Some businesses are more affected than others by the wider economy – but if the mood among consumers and other businesses is pessimistic, then you are ultimately less likely to get a large new order. On the other hand, the rate cut is designed to counter that very issue.

A further problem for SMEs is that if they agree to business loans when the rates are low, these are more likely to go up in the future and cause cash flow problems. Owners can protect against this either by paying the bank a premium to fix the interest rate for a number of years, or by choosing a more flexible form of business finance that doesn’t tie the recipient into an onerous repayment schedule, being Invoice Finance and Trade Finance. Some might say it’s a no-brainier.

Get tomorrow’s cash flow today.