Innovations in Invoice Finance: AI-Based Risk Assessment & Faster Cash Access

In recent years, the fintech landscape has been shifting quickly. From digital wallets to embedded finance, the goal has been consistent across the board: make

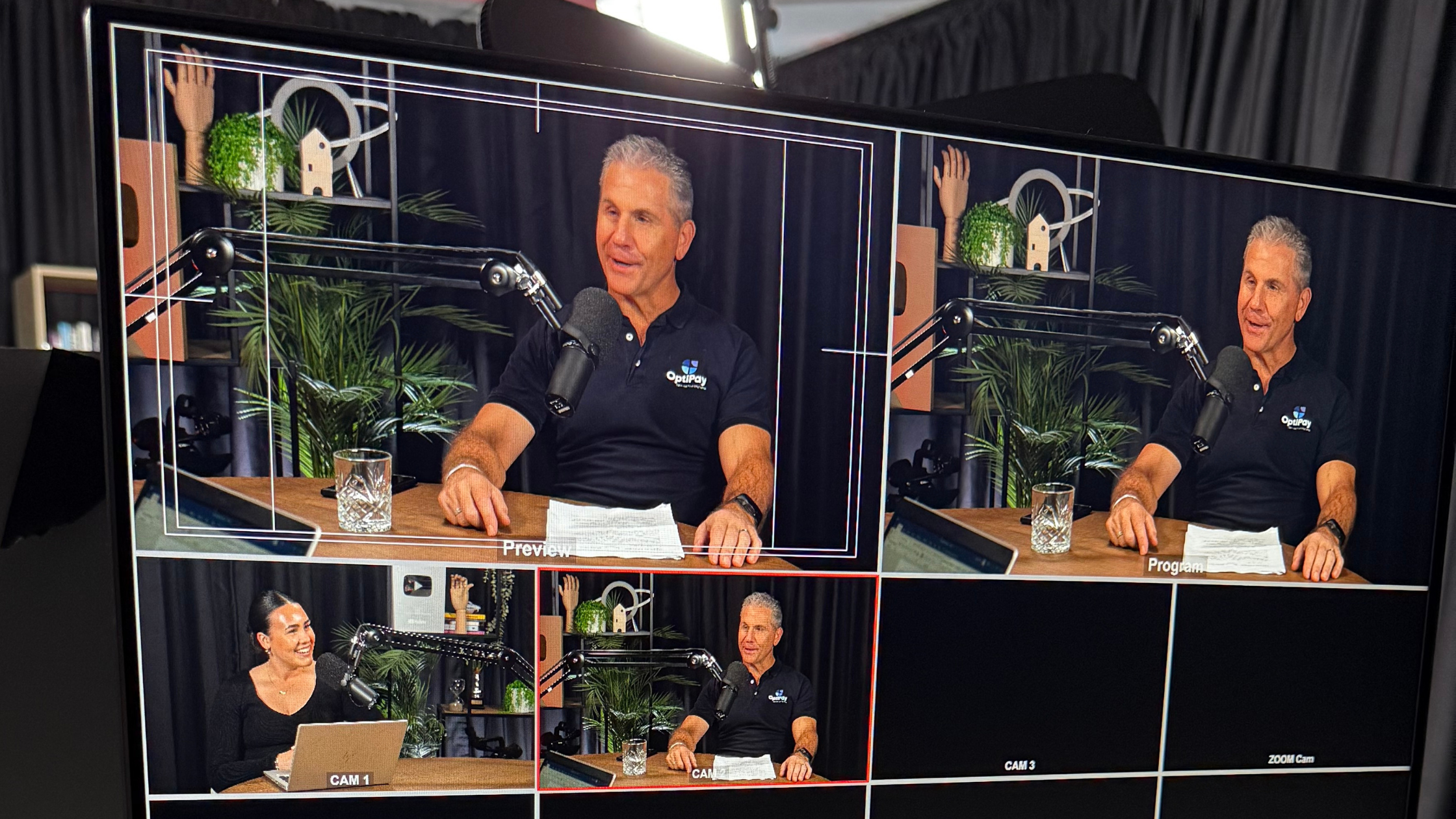

The OptiPay blog is a useful resource to assist you fully appreciate the benefits of innovative business

funding solutions. We post regular contributions from business leaders, as well as case studies, industry

news, and tips and tools from our OptyiPay experts. John Test

In recent years, the fintech landscape has been shifting quickly. From digital wallets to embedded finance, the goal has been consistent across the board: make

A Conversation with Accountants Daily The role of accountants is evolving. Beyond compliance, businesses are looking to you for guidance on market share growth, resilience,

Late payments are more than just a nuisance for Australian businesses. They are one of the most common and persistent cash flow challenges. Whether you’re

Running a seasonal retail business is a balancing act. When demand surges during the summer or winter months, inventory needs to be high, staff must

For small and medium-sized businesses, access to funding can mean the difference between drowning and growing. Whether you’re hiring staff, investing in marketing, or simply

As we enter FY26, many Australian businesses are looking ahead to changes in tax compliance and payment obligations introduced by the Australian Taxation Office (ATO).

Electricians, plumbers, and other tradesmen help to keep both homes and businesses functioning safely. These small trade businesses are the backbone of Australia’s infrastructure, yet

Businesses who operate in the hospitality sector, whether it be your local café or a luxury hotel, play a key role in Australia’s economy. However,

Australians turn to labour hire for a range of reasons. From meeting short-term or fluctuating workforce demands to tapping into specialised skills without the constraints