What is Invoice Finance and who is it for?

We’ve discussed many aspects of Invoice Financing prior to this blog but perhaps it’s time to go back to basics – after all, more than 30% of eligible businesses are sadly still unaware that it exists. Also known as Invoice Discounting or Debtor Finance, Invoice Finance is a form of business funding which sees cash […]

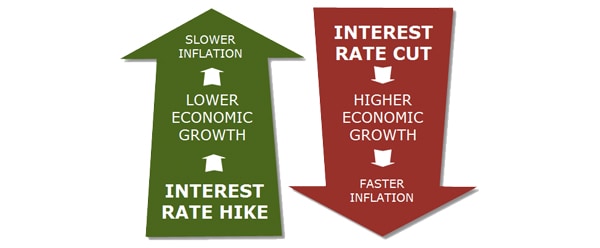

A Matter of Interest: How the Reserve Bank of Australia Affects Your Business

The Reserve Bank of Australia kept interest rates on hold this month, but many commentators believe it will cut them at least once before the end of the year. What does this mean for businesses and their ability to finance their plans? As a small or medium sized-business owner, you are probably focused on your […]

Turn Cash Flow into an Asset

Cash flow is a word that can strike fear into business owners, because it’s often followed by the word ‘problems’. However, it doesn’t have to be that way: if managed correctly, a business’ cash flow situation becomes an asset that can be used to fund investment and growth. The way you think about cash flow […]

Financing the Final Frontier

Since the Australian Space Agency was belatedly founded last year, interest in the country’s space sector has been rocketing. The fledgling agency recently announced a “statement of strategic intent” with aerospace giant Boeing as part of plans to grow Australia’s space market from about $2.8 billion to $8.6 billion by 2030; and just last week, […]

SME Tax Cuts Can Fund Growth

When a government announces tax cuts for business, there is always a simple premise behind the move: it is aimed at encouraging growth. The recent Australian Federal Budget is no different, and businesses will seize the opportunity to invest in themselves. Targeting businesses with an annual turnover of less than $50m, the government recently promised […]

Businesses are Looking Beyond Loans for Funding

Despite assurances from banks that they want to support the country’s crucial small business sector, there was more evidence last week that bank lending to SME’s is in steady decline. Could it be that more and more Australian businesses are simply choosing different options for their funding? Analysis by The Australian Financial Review showed growth in bank […]

The Benefits of International Trade

The latest balance of trade figures show that Australia’s surplus surged to its highest monthly total on record in January. However, the real good news was hidden a little further down the statistical bulletin: both exports and imports rose at the start of 2019, and that is great for business. The popular media like to […]

Your Business Finance Should Match Your Situation

With so many business funding propositions out there, and the financing landscape changing all the time, it is only right that entrepreneurs and managers seek to compare the options available. In doing so, the key is not just to look at headline prices but to closely consider their own business situation and ambitions, and match […]

OptiPay Joins Book Launch on Heroic Business Men and Women of Australia

Angus Sedgwick, CEO of OptiPay joined other successful Australian Business owners and shared their inspiring stories for the 2nd edition of 50 Unsung Business Heroes. This collective of Australian small business CEOs and founders, share their stories of true grit and determination, of long hours and lonely nights. A Croatian soldier had to sell his […]

What Now for Business Loans?

It’s been a busy few months for the Australian SME lending market, culminating in Kenneth Hayne’s Banking Royal Commission report which some believe will have a knock-on effect on the availability of business loans from the major banks. At the same time, small and medium sized businesses are eagerly awaiting the advent of the state-backed […]