5 Tips for Picking the Right B2B Funder for Your Business

For small- to medium-sized businesses in particular, bringing on a B2B funder is often one of the best ways to help navigate the admittedly rough

The OptiPay blog is a useful resource to assist you fully appreciate the benefits of innovative business

funding solutions. We post regular contributions from business leaders, as well as case studies, industry

news, and tips and tools from our OptyiPay experts. John Test

For small- to medium-sized businesses in particular, bringing on a B2B funder is often one of the best ways to help navigate the admittedly rough

Make your business stand out against the competition in 2017 with these four smart marketing hacks. The rise in digital technology means most people can

2016 has been a year filled with extended supplier payments. From Rio Tinto’s extension from 30 days to 90 days to Kelloggs and Fonterra stretching

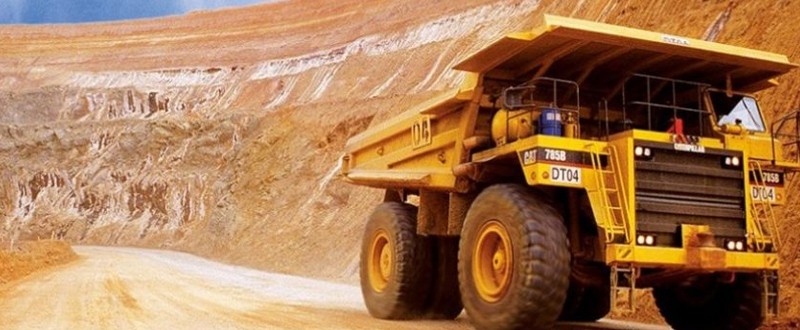

The mining industry is highly competitive and often characterised by enormous projects with huge budgets. When payments are stalled, business owners need to make a

Running a business is similar to running a household. There are key stakeholders, mouths to feed, and relationships with other ‘families’ — all as a

Invoice financing is a great way to ensure consistent cash flow in your business. When dealing with slow debtors — having a third party purchase

As a business owner, having your finger on the latest trends has a direct impact on the success of your business. Understanding these three trends

http://www.youtube.com/watch?v=wDZHnnEBsC4 Who is OptiPay? OptiPay, one of Australia’s leading business finance providers, has been dedicated to helping small business owners solve cash flow challenges for

Although many Australian businesses experience their highest sales during the Christmas period, for some it can be the toughest time to maintain healthy cash flow.