The 2017 Australian Business Lending Landscape

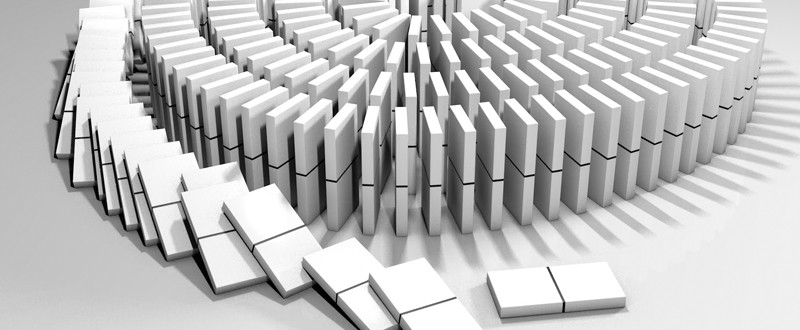

The fact that the Australian business lending landscape is expected to change as 2017 plays out should come as a surprise to nobody. Lending as

The OptiPay blog is a useful resource to assist you fully appreciate the benefits of innovative business

funding solutions. We post regular contributions from business leaders, as well as case studies, industry

news, and tips and tools from our OptyiPay experts.

The fact that the Australian business lending landscape is expected to change as 2017 plays out should come as a surprise to nobody. Lending as

If your business is looking for a flexible, invoice financing solution try out our flexible invoice finance calculator here. We have no applications fees, no

The expansion of a business is an exciting prospect, one filled with the promise of an extended reach and higher profits. Your growth may be

Way back in the day, Shakespeare wrote, “All the world’s a stage, and all the men and women merely players”. Today, the stage has changed,

Nearly every business, regardless of the size, has problems meeting their regular obligations at one time or another. Standard expenses like paying suppliers, meeting payroll

For those of us who’ve been around long enough to remember the ‘Oils Ain’t Oils’ advertisement, it is an apt reminder that not all business

Most companies stall or fail not because of bad product but because of bad cash flow. If you are among the SMEs that leave invoices

Is your business dealing with extended supplier payments or seasonal fluctuations? Perhaps your customers just can’t seem to pay on time. Whatever the cause of

Regardless of how much experience you have in the mining industry or how stable your business happens to be, late payments can spell trouble for