What is Invoice Finance and who is it for?

We’ve discussed many aspects of Invoice Financing prior to this blog but perhaps it’s time to go back to basics – after all, more than

The OptiPay blog is a useful resource to assist you fully appreciate the benefits of innovative business

funding solutions. We post regular contributions from business leaders, as well as case studies, industry

news, and tips and tools from our OptyiPay experts. John Test

We’ve discussed many aspects of Invoice Financing prior to this blog but perhaps it’s time to go back to basics – after all, more than

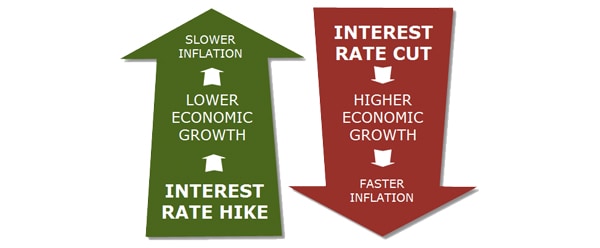

The Reserve Bank of Australia kept interest rates on hold this month, but many commentators believe it will cut them at least once before the

Cash flow is a word that can strike fear into business owners, because it’s often followed by the word ‘problems’. However, it doesn’t have to

Since the Australian Space Agency was belatedly founded last year, interest in the country’s space sector has been rocketing. The fledgling agency recently announced a

When a government announces tax cuts for business, there is always a simple premise behind the move: it is aimed at encouraging growth. The recent

Despite assurances from banks that they want to support the country’s crucial small business sector, there was more evidence last week that bank lending to

The latest balance of trade figures show that Australia’s surplus surged to its highest monthly total on record in January. However, the real good news

With so many business funding propositions out there, and the financing landscape changing all the time, it is only right that entrepreneurs and managers seek

Angus Sedgwick, CEO of OptiPay joined other successful Australian Business owners and shared their inspiring stories for the 2nd edition of 50 Unsung Business Heroes.